When evaluating sales tools, the real question isn't just "How much does Apollo cost?" but rather "Will I actually get value from what I'm paying for?" This distinction matters more than ever in 2025, as sales teams face increasing pressure to justify every line item in their tech stack budget.

Apollo.io has established itself as a comprehensive sales intelligence and engagement platform, combining prospecting data, email automation, and CRM capabilities into one system. But with pricing that ranges from free to several hundred dollars per user monthly, determining whether it's worth the investment requires looking beyond the surface-level features.

In this article, we'll evaluate Apollo pricing: breaking down costs by team size, calculating real ROI, identifying what signals poor value, and highlighting scenarios where the investment pays for itself multiple times over. By the end of this article, you'll have a clear framework for deciding whether Apollo pricing makes sense for your specific situation.

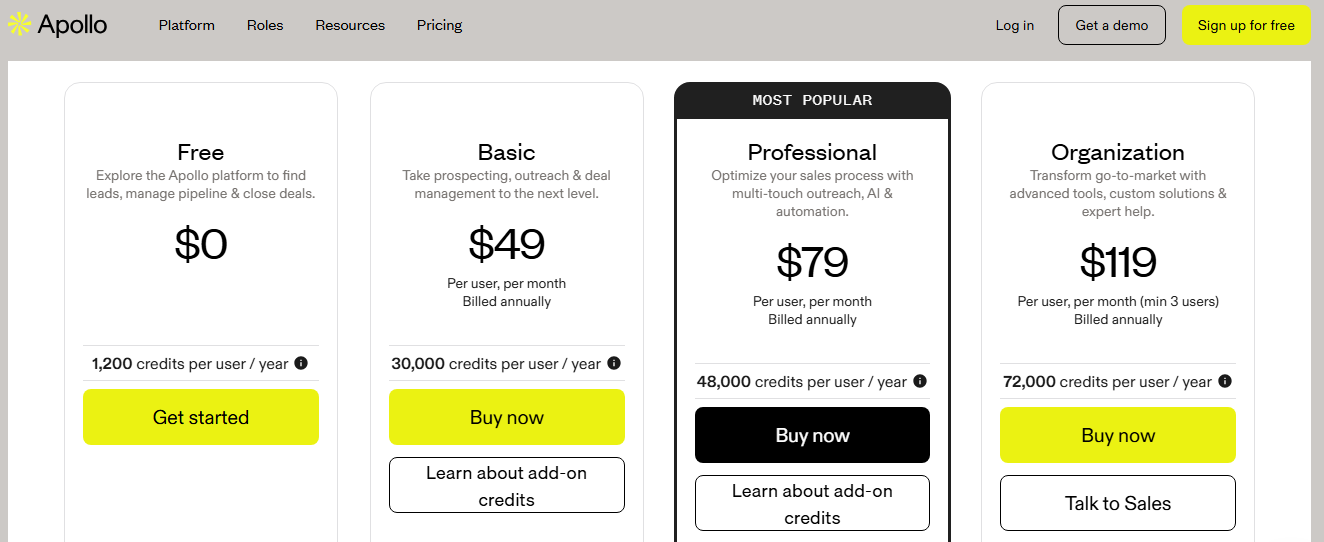

Apollo operates on a per-user pricing model with four main tiers, each designed for different stages of business growth.

The Free Plan provides basic access to Apollo's contact database and limited email capabilities. You can search for prospects by name and company, compose basic email sequences, and send up to 250 emails daily. However, you won't get full contact details like email addresses or phone numbers, and you're limited to just 10 mobile credits monthly for data enrichment.

The Basic Plan at $49 per user monthly unlocks the contact database with full details, allowing unlimited email sends per day (though you can compose up to 250,000 monthly with AI assistance). You gain access to buying intent data for six keywords and basic email analytics showing opens and clicks. This tier includes 120 mobile credits and 12 export credits monthly.

Moving up to the Professional Plan at $79 per user monthly, you get everything from Basic plus calling capabilities, unlimited sequences for email automation, advanced analytics with custom reports and goal tracking, and 500 monthly credits for automation tasks. The data export limit increases to 48 credits monthly, and you can track engagement scoring to prioritize your hottest leads.

The Organization Plan at $119 per user monthly (with a three-user minimum) adds enterprise-grade security features like single sign-on and custom permission profiles, international calling capabilities, priority support, and increased credits across the board. This tier is built for larger teams that need advanced administrative controls and global reach.

Finally, Custom Enterprise solutions are available for organizations needing tailored features, dedicated support, or volume discounts beyond standard offerings.

Apollo pricing appears straightforward at first glance, but several hidden costs can significantly impact your total investment.

The credit system operates as a secondary currency within Apollo. While each plan includes a monthly credit allotment, certain actions consume these credits rapidly. Data enrichment might cost 1-3 credits per contact depending on the information requested. Building complex automation workflows consumes credits per execution. Exporting large contact lists requires export credits. When you run out mid-month, additional credits cost $0.01 each, which adds up quickly if you're running high-volume operations.

Integration expenses represent another often-overlooked cost. While Apollo connects with popular CRMs like Salesforce and HubSpot, you may need middleware tools like Zapier for more complex automation between systems. Some integrations require API development work, especially if you're connecting proprietary internal systems. These integration projects can cost thousands of dollars and weeks of development time.

Training and onboarding require substantial time investment that translates to real costs. Your team needs to learn Apollo's interface, understand best practices for sequences, and develop workflows that leverage the platform's capabilities effectively. Plan for 2-3 weeks of reduced productivity per team member during the learning curve, plus ongoing training as new features roll out.

The per-user pricing model creates scaling challenges. If you have five sales reps on the Professional Plan, you're paying $395 monthly. Add three more team members, and you're suddenly at $632. This linear cost increase can strain budgets as teams grow, unlike usage-based pricing models where costs scale more gradually.

Apollo has evolved its pricing structure over recent years, and 2025 brings both improvements and adjustments that affect overall value.

Feature additions have enhanced value across all tiers. The AI-powered email composition has become more sophisticated, generating more personalized content with less editing required. Intent data coverage expanded to more industries and keywords. The mobile app improved significantly, allowing field sales teams to access data and update records on the go.

Credit allocations increased across paid tiers in response to customer feedback about running out too quickly. Professional Plan users now get 500 automation credits monthly, up from 300 previously. This change acknowledges that effective use of the platform requires generous credit allowances.

However, some legacy features were deprecated or moved to higher tiers. Certain advanced filtering options that were once available on Basic moved to Professional. The free plan became more restrictive in daily email send limits, dropping from unlimited to 250 per day.

Pricing itself has held relatively steady, with Apollo resisting the urge to raise base rates despite inflation. This stability represents genuine value retention compared to competitors who've increased prices 15-25% over the same period.

ZoomInfo represents Apollo's primary enterprise competitor, with key differences affecting value calculations.

Feature Parity: ZoomInfo offers deeper company intelligence including org charts, department sizes, technology spend estimates, and more granular intent data. Apollo provides stronger engagement tools like built-in calling, email sequencing, and CRM capabilities. Neither is strictly "better"—they serve different primary purposes.

Pricing Differences: ZoomInfo costs significantly more per user for professional plans. This five times more price difference makes Apollo attractive for smaller teams or those prioritizing engagement over pure intelligence.

Data Accuracy: Independent testing shows ZoomInfo maintains 92-94% contact accuracy versus Apollo's 85-88%. This gap narrows for high-profile companies in major markets but widens for smaller companies or niche industries. The accuracy difference matters most for high-volume cold calling where wrong numbers waste substantial time.

When Each Makes More Sense: Choose ZoomInfo if you're an enterprise organization needing the deepest possible intelligence, targeting Fortune 5000 accounts where comprehensive org mapping justifies premium pricing, or operating in highly regulated industries requiring maximum data verification. Choose Apollo if you're a small-to-mid-size company prioritizing cost efficiency, need integrated engagement tools beyond just data, or target SMB and mid-market where both databases offer similar coverage.

Apollo vs. LinkedIn Sales Navigator

Many sales professionals wonder whether they need Apollo when they already pay for Sales Navigator.

Core Functionality Overlap: Both help identify prospects at target companies, provide business insights and news, offer some contact information (LinkedIn for social contact, Apollo for email and phone), and support list building and tracking.

Where They Differ Dramatically: Sales Navigator excels at social selling and relationship-based outreach, leveraging warm introductions through mutual connections, and researching individual buyer behavior patterns. Apollo dominates at cold outreach at scale, providing direct contact information beyond LinkedIn, and automation for multi-channel sequences.

Combined Pricing Considerations: Sales Navigator Core costs $119/month. Adding Apollo Basic at $49 brings total cost to $168/month per user. While not cheap, this combination covers both warm and cold outreach channels comprehensively.

Use Case Fit: Use Sales Navigator alone if your sales motion relies primarily on referrals and warm introductions, you're in relationship-heavy industries like financial services or consulting, or you sell high-ticket items requiring extensive research and relationship building. Add Apollo when you need to scale outbound beyond your immediate network, supplement referrals with cold outreach during slow periods, or build predictable pipeline independent of networking activities.

Apollo vs. Hunter.io + Alternative Tools

Some teams attempt building a "stack" of specialized tools instead of Apollo's all-in-one approach.

Building a Stack Approach: A typical alternative stack might include Hunter.io for email finding, Instantly.ai or Lemlist for email automation, Lusha or Seamless.ai for phone numbers, LinkedIn for research, and Zapier for connecting everything.

Functionality Gaps: This piecemeal approach creates workflow friction requiring manual data transfer between tools, lacks unified reporting across channels, creates data consistency issues, and demands more technical setup and maintenance. Time lost to tool-switching and data transfer often outweighs any cost savings.

Total Cost Comparison: While individual tools might cost less, the combination often matches or exceeds Apollo pricing—especially when factoring in the premium for your time managing multiple subscriptions, updating data across platforms, troubleshooting integration issues, and training team members on multiple interfaces.

Management Overhead: Every additional tool adds complexity. You're managing multiple vendor relationships, dealing with different billing cycles and terms, and troubleshooting when integrations break. For teams smaller than 10 people, this overhead typically isn't worth marginal cost savings.

Apollo pricing in 2025 depends on your sales model and team size. For B2B teams with clear target profiles, high outbound volume, and disciplined processes, it can pay for itself in 3–6 months with strong ROI. It’s less effective for niche markets, referral-driven sales, or teams lacking sales ops structure. Start with the Free Plan, set 90-day success metrics, and upgrade only if real results prove its value.

Apollo offers a Free Plan with limited features including basic database access (search by name only), up to 250 emails sent daily, and 10 monthly mobile credits. It's ideal for testing the platform or very light usage. The cheapest paid plan is Basic at $49 per user monthly, which unlocks full contact details, unlimited daily email sending, and 120 mobile credits.

Yes, all Apollo plans include credits for various activities. The Basic Plan includes 120 mobile phone credits monthly for enriching contact phone numbers. Professional and Organization plans include higher credit allocations. Phone calling capabilities (actually making calls through Apollo's dialer) are included only on Professional ($79/user/month) and Organization ($119/user/month) plans.

Technically you could share login credentials, but this violates Apollo's terms of service and creates significant practical problems. You'll lose individual activity tracking, can't assign tasks to specific people, create collaboration bottlenecks when multiple people need access simultaneously, and risk account suspension if Apollo detects shared usage. Per-user pricing exists for a reason—buy appropriate seats for your team size.

Apollo doesn't block your access when you run out of credits. Instead, you can purchase additional credits at $0.01 per credit. You'll see notifications in the platform showing your remaining credit balance, and you can buy more credits as needed. However, regularly exceeding your credit allocation signals that you should upgrade to a higher plan tier with more included credits, which is typically more cost-effective than constantly buying overages.

Apollo doesn't advertise a formal startup program, but there's some negotiation flexibility, especially for annual commitments. Small startups (1-3 users) typically have limited negotiating power and pay published rates. Funded startups deploying 10+ seats can often negotiate 10-15% discounts through annual prepayment. Your best leverage comes from committing to annual contracts or comparing Apollo pricing to competitive quotes from ZoomInfo or similar platforms. Reach out to Apollo's sales team directly and ask what flexibility they can offer.

Apollo is significantly less expensive than ZoomInfo. ZoomInfo typically costs more per user annually, making it more expensive than Apollo. However, ZoomInfo provides deeper company intelligence, better data accuracy (92-94% vs. Apollo's 85-88%), and more comprehensive coverage of enterprise accounts. Apollo offers stronger engagement tools like built-in email sequencing and calling. For small-to-mid-size businesses, Apollo's pricing provides better value. For enterprise organizations targeting Fortune 5000 accounts, ZoomInfo's premium data might justify the higher cost.

The Apollo Free Plan includes searchable access to millions of business contacts (though you can only see names, not full contact details), ability to compose up to 5,000 emails monthly with AI assistance, 250 emails sent per day, 10 mobile credits monthly for phone number enrichment, basic email tracking (sends but not opens/clicks), integration with Gmail and Outlook, and access to the Chrome extension for basic functionality. It's genuinely useful for testing data quality and learning the platform, but too limited for running serious prospecting campaigns.

If you're on a monthly billing cycle, you can downgrade to a lower-tier plan at any time, with the change taking effect at your next billing date. If you've committed to an annual contract, you're generally locked into that plan level for the contract term. However, you can often negotiate with Apollo's customer success team if your circumstances have changed significantly. Downgrading means losing access to premium features immediately, so ensure your workflows don't depend on Professional or Organization-level features before downgrading to Basic.